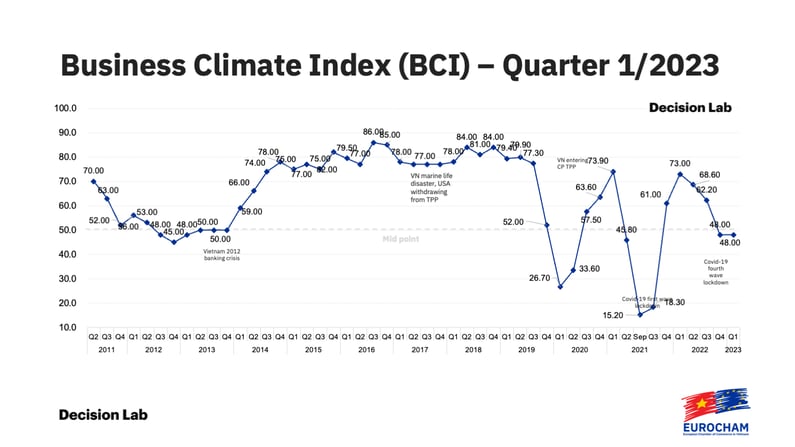

European business leaders remain cautious, but see signs of improvement in Vietnam's economy, according to the latest Business Climate Index (BCI) report released by the European Chamber of Commerce in Vietnam (EuroCham) and produced by Decision Lab.

The BCI, which quantifies the business sentiment of the European business and investment community in Vietnam, held steady at 48.0 in the first quarter of 2023. Though it remains at the same level it registered as 2022 drew to a close, there are promising indications that European business stakeholders are witnessing a positive shift in their economic outlook.

The Business Climate Index is widely regarded as the premier metric for gaining insight into the European business and investment community's perceptions of the Vietnamese market. Assembled from feedback gathered from EuroCham Vietnam's expansive network of 1,300 members, who collectively represent nearly every sector of the country's dynamic economy, this quarterly survey delivers indispensable insights into the current state of Vietnam's business environment and provides a snapshot of what to expect in the future.

Download the full BCI Q1 2023 report for a comprehensive overview of the findings.

Modest Business Outlook Improvements

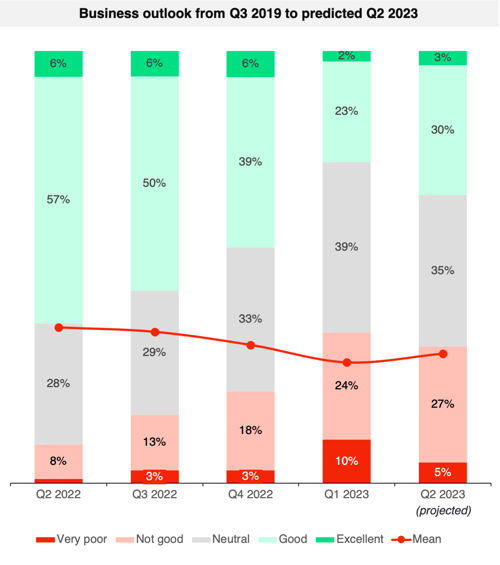

Encouragingly, the business environment outlook for 2023 is displaying promising signs of betterment. Specifically, the number of respondents who are sanguine about the nation's economy has risen by 8 points, signalling a growing faith in its prospects.

Likewise, a notable uptick in the number of individuals anticipating the stability and growth of the economy was observed. According to the survey, the number of individuals expecting a downturn in the economy decreased by 6%, while the number of those forecasting an upturn in revenue and orders increased by 7%.

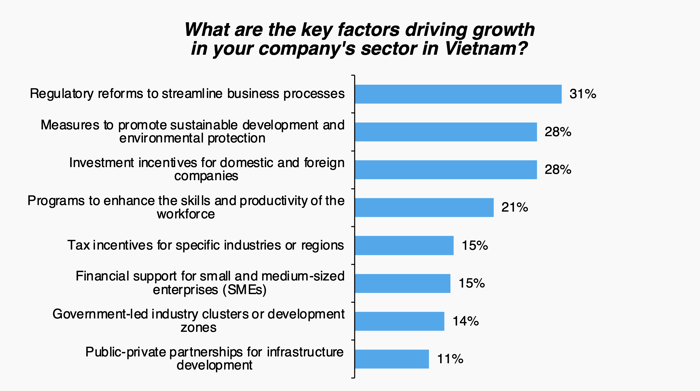

Policy Measures Driving Sustained Business Growth and Success

Through a range of strategic initiatives aimed at enhancing the business environment, Vietnam has emerged as a leading destination for foreign investment and domestic enterprises alike. Based on feedback from survey participants, regulatory simplification, sustainable development measures, investment incentives, and workforce development programs have all played a key role in creating prime conditions for long-term economic success.

The survey results also indicate that the European business and investment community is broadly content with the level of attention policymakers have given to business needs in Vietnam, with a third of respondents expressing significant or moderate satisfaction. This positive feedback is a testament to the government's ongoing commitment to fostering a business-friendly environment in the country.

Download the full BCI Q1 2023 report for a comprehensive overview of the findings.

Vietnam's Appeal as an FDI Destination

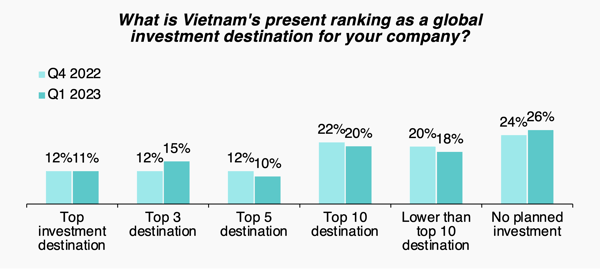

Vietnam's draw as a foreign direct investment (FDI) destination remains strong among European business leaders, with 3% more European business stakeholders citing it as one of their top three investment hotspots worldwide. Overall, precisely 36% of those surveyed ranked Vietnam either first, within their top three, or among their top five investment destinations on a global scale.

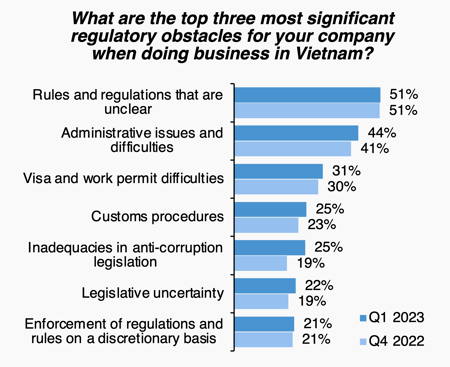

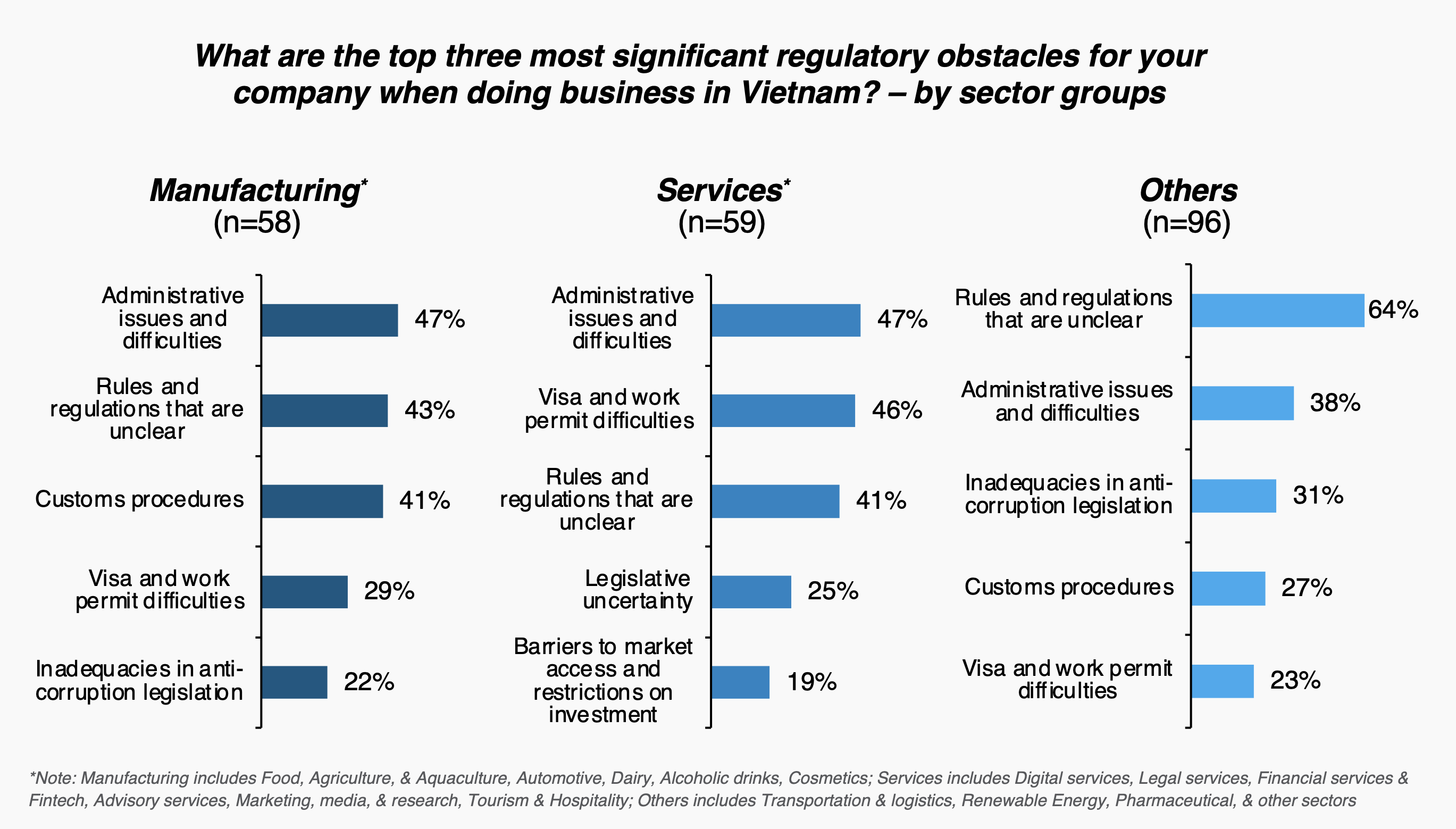

Despite this, foreign businesses in Vietnam continue to grapple with regulatory opacity, administrative inefficiencies, and visa and work permit issues. There has been an observable upward trend in the number of respondents pointing out inadequacies in anti-corruption legislation.

The manufacturing sector faces an additional hurdle in the form of complicated customs procedures, while services firms are confronted with the prominent challenge of visa and work permit difficulties. Furthermore, various other industries, such as transportation, pharmaceuticals, and renewable energy, are also hampered by the lack of adequate anti-corruption legislation.

The manufacturing sector faces an additional hurdle in the form of complicated customs procedures, while services firms are confronted with the prominent challenge of visa and work permit difficulties. Furthermore, various other industries, such as transportation, pharmaceuticals, and renewable energy, are also hampered by the lack of adequate anti-corruption legislation.

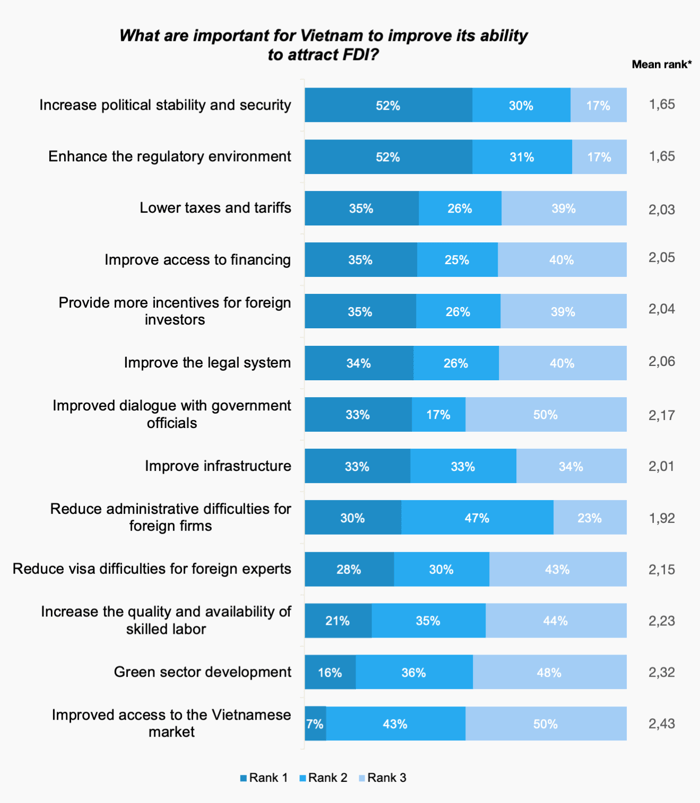

To strengthen Vietnam's appeal as a dynamic investment locale, participants in the BCI reinforced the need for improvements in political stability, regulatory frameworks, and tax and tariff regimes. These measures would go a long way in addressing the concerns of foreign businesses and bolstering investor confidence in the country's economic prospects.

Commenting on the BCI, EuroCham Chairman Gabor Fluit said:

“While a score of 48 might not appear impressive, it is encouraging that the situation is not deteriorating further. The fact that the score is not dropping is a sign of progress, even if it is still far from ideal. This gives us hope that the situation can be improved with further effort.

As we have all seen in the past, the Vietnamese government takes swift and decisive action during times of crisis. Therefore, we expect more productive measures in the second half of the year.

Upcoming reforms to work permit and travel visa procedures will likely have a direct impact on growth. We eagerly await further information on these proposed changes. There has also been a notable improvement in liquidity in recent months, and we believe that a clear indication from the government on improved access to finance would boost morale.

Overall, we have a positive outlook on the future of Vietnam's economy and we are looking forward to engaging in productive conversations with the Vietnamese government. We are enthusiastic about working together to take on the challenges and embrace the opportunities ahead.”

CEO of Decision Lab Thue Quist Thomasen added:

“There are two components to the score: sentiment during the first quarter of 2022 and an outlook for the future. This time around, the first quarter score is stable, while the future outlook is more positive. This could indicate that we are at a turning point. Orders are also picking up, while investments and hiring remain relatively low. This indicates that this is still a “wait and see” period for many companies, but improvements may be on the horizon.

Despite the improved outlook, it is important to keep in mind that the economy is still fragile and caution is warranted. It is also essential to monitor the current situation in order to anticipate any potential changes in the market. Taking a proactive approach to the current situation may be the best way to ensure success in the future."

Download the full BCI Q1 2023 report for a comprehensive overview of the findings.