Lower salaries and precarious personal finances are driving growing demand for consumer credit, according to new research from Home Credit Vietnam, a consumer finance provider, and market research consultancy Decision Lab. The research also reveals that people on low incomes need support to improve their financial literacy to better balance their budgets.

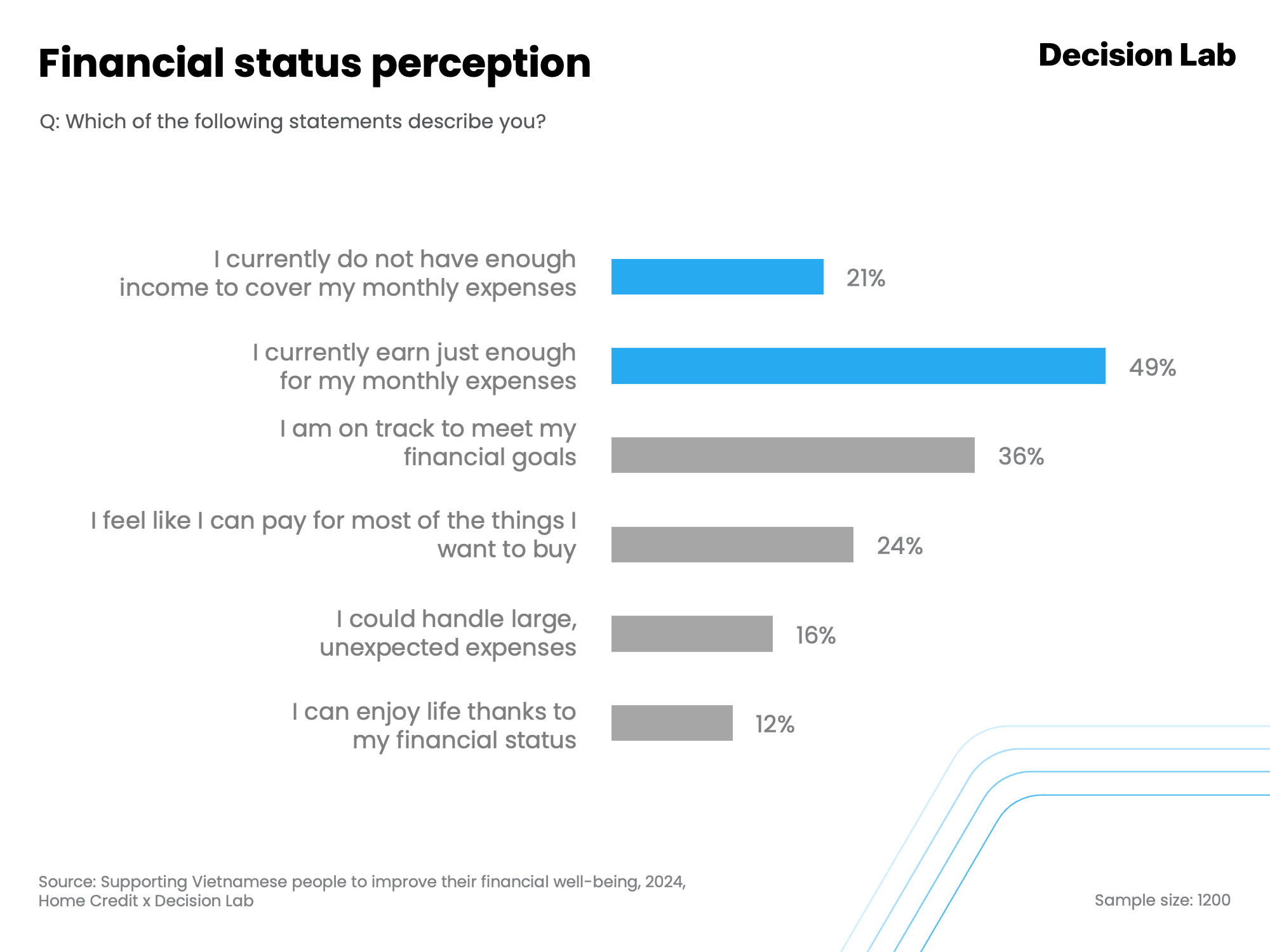

Published in a report, ‘Supporting Vietnamese People to Improve their Financial Well-being’, the research shows that most people saw their incomes stagnate in 2023. About one-third (36%) earned less last year than in 2022. A further third (34%) saw little to no change in their monthly incomes. Today, one-fifth (21%) of people struggle to cover their regular monthly expenses. Meanwhile, half (49%) earn just enough to afford the basic essentials each month.

Download the full report at the Decision Lab’s website.

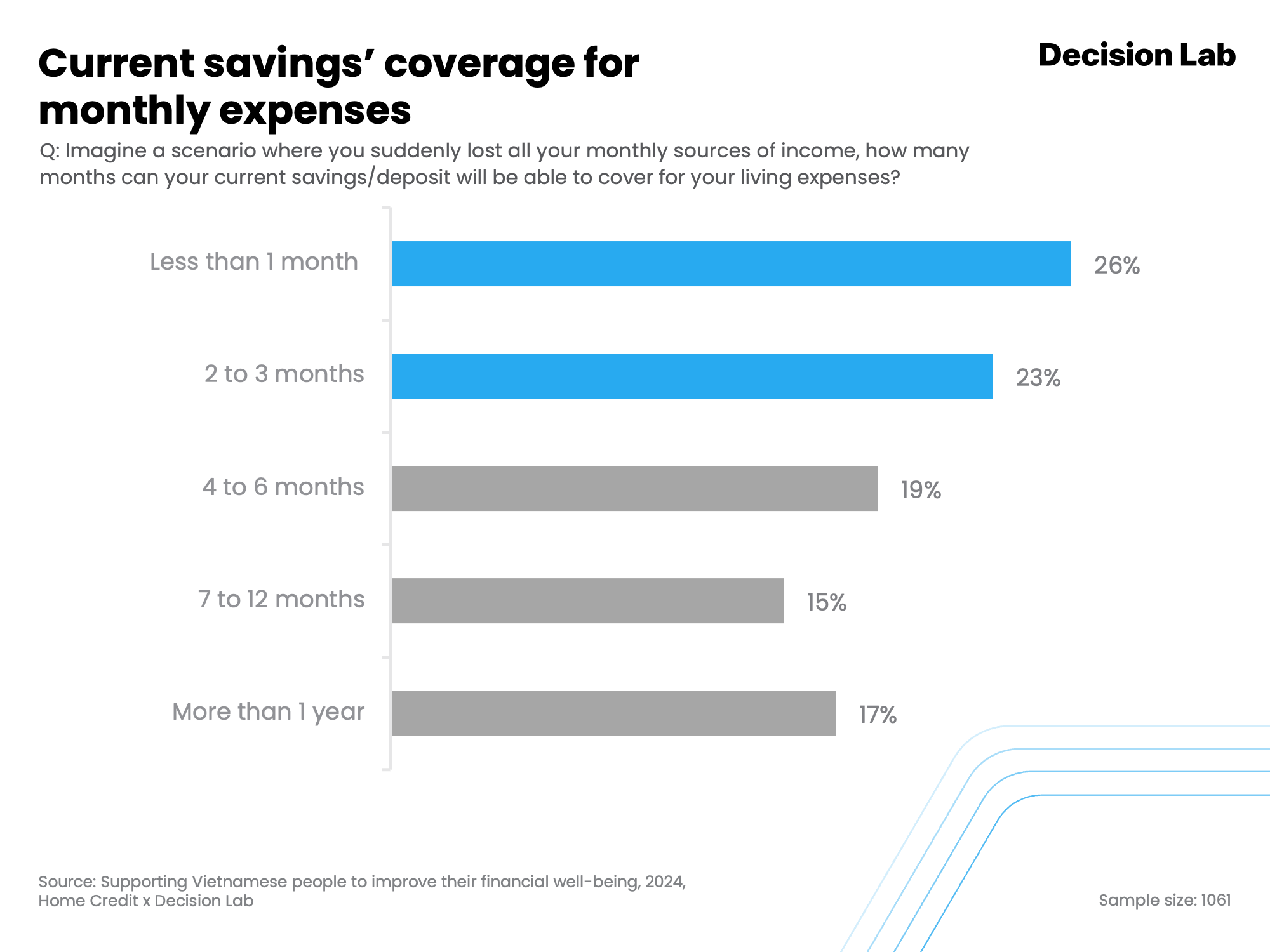

For this reason, most people want to save more for emergencies. However, just a third (35%) managed to do so in 2023. And nearly half (49%) have sufficient savings to cover essential expenses for a maximum of three months. Those with low salaries – below VND 5 million a month – are in the most precarious position regarding their personal finances.

Growing demand for credit

This is creating greater demand for consumer credit and personal finance products. However, not all consumers can borrow from banks. For example, those on low incomes might not have the paperwork required for a bank loan. About a third of people either do not have or would not be comfortable providing their labour contract (31%) or wage slip (33%) as part of a loan application.

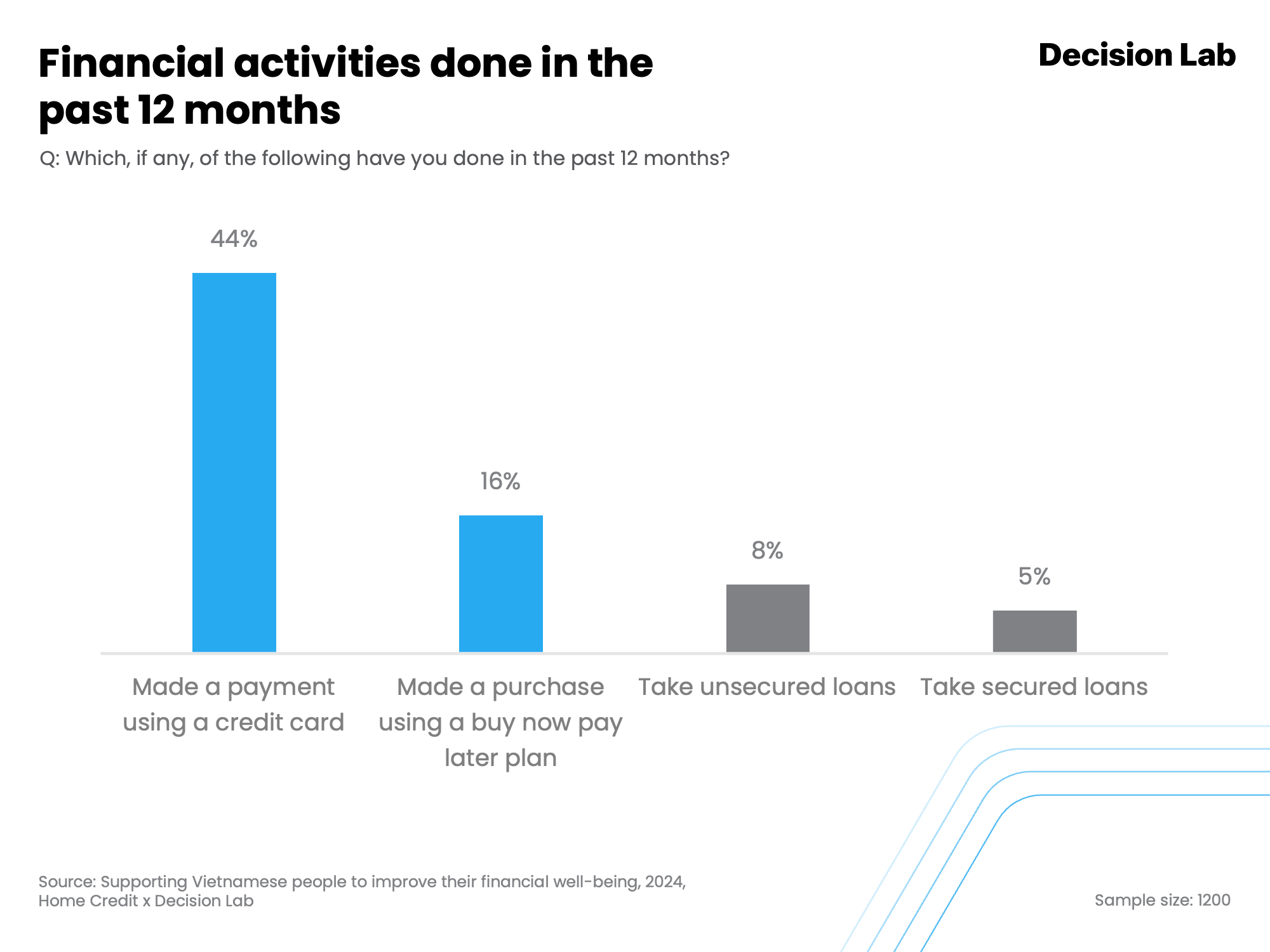

This lack of access to loans is increasing the appeal of credit cards and buy-now-pay-later (BNPL) plans. Almost half (44%) of people used a credit card over the last 12 months. Meanwhile, BNPL has amassed a 16% share of the consumer credit market despite being a relative newcomer to Vietnam.

Download the full report at the Decision Lab’s website.

However, almost 40% of people with a loan or credit debt over the last 12 months struggle to meet their monthly repayments. Some reasons for this include a lack of financial literacy and poor awareness of the consequences of defaulting on debt. For example, about half of people who have taken out a loan are unaware that missed repayments could lead to a bad credit rating (46%), financial penalties (49%), or problems getting credit in the future (57%).

Thue Quist Thomasen, CEO of Decision Lab, said:

“Our new report highlights that a significant group of Vietnamese consumers – those on low incomes or lacking certain documents – are underserved when it comes to personal finance and borrowing. This represents a real gap in the market for consumer credit companies who can offer these customers innovative financial products, utilizing digital-first platforms and streamlined application procedures.”

Bridging credit and financial literacy gaps

Consumer finance companies can help to bridge these gaps in access to credit and financial literacy. Unlike banks, consumer finance companies can make it easier for people on low incomes to access credit through simpler application forms, faster approval procedures, and more convenient digital platforms.

Meanwhile, consumer finance companies are in a position to empower people to take control of their money through strengthening financial literacy. Educating customers on borrowing, budgeting, and saving can help them avoid irresponsible lenders and achieve their long-term financial goals.

Download the full report at the Decision Lab’s website.

Commenting on the report, Mr. Jakub Kudrna, Chief Strategy Officer of Home Credit Vietnam, said:

“For nearly 16 years in Vietnam, Home Credit has been more than just a financial institution; we have become a top trusted companion to over 16 million customers and thousands of partners across the country. We take pride not only in being the market pioneer but also in leading the way with sustainable growth practices. Our innovative and responsible financial solutions have made financing more accessible, affordable, and secure for millions of customers, fostering financial inclusion and contributing to the country's economic growth.

This inaugural report, produced in collaboration with Decision Lab, reflects our passion for the work we do. It embodies our aspiration to share insights, inspire change, and collectively enhance our financial ecosystem. We see this as an opportunity to work alongside our peers in the industry—to learn, to grow, and to contribute even more to the consumer finance sector and to the broader Vietnamese economy.”

About the research

An online survey was created to discover consumer perceptions and behaviour and distributed to 1,200 respondents aged 18 and over representative of Vietnam’s national online population who were recruited using random online sampling. The survey was conducted between 1 and 7 December 2023.

Download the full report at the Decision Lab’s website.