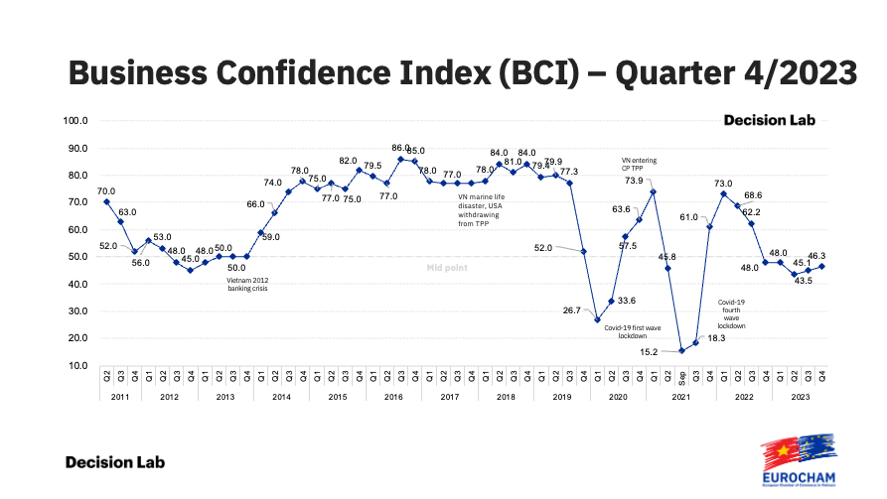

Confidence among European businesses operating in Vietnam is showing signs of resilience as the latest Business Confidence Index (BCI) from the European Chamber of Commerce in Vietnam (EuroCham), conducted by Decision Lab, reached 46.3 in the fourth quarter of 2023. While this uptick signals gradual stabilisation, it's vital to highlight that the BCI has remained below the midpoint since Q4 2022. Notably, over one-third of businesses anticipate underperformance, underlining a cautious outlook amid persistent market weaknesses.

EuroCham Chairman Gabor Fluit commented on this development, saying, 'There's definitely a positive trend underway. While we still have a long way to go for a full recovery, businesses are feeling more hopeful." He added, 'The European business community is increasingly optimistic that the most challenging economic period is now behind us.'"

To read the full Q4 2023 Business Confidence Index report, click here.

The quarterly BCI offers a snapshot of European investor sentiment in Vietnam. Conducted since 2011, it surveys a pool of over 1,400 EuroCham members across various sectors, delivering real-time observations into the ever-evolving dynamics of this vibrant Southeast Asian market.

European business confidence on the rise

As Vietnam's business landscape transitioned from Q3 to Q4 2023, subtle yet telling shifts in sentiment emerged. While there was a slight 2 percentage point dip in overall optimism for economic stability and growth, this was more than offset by a drop of 14 percentage points in expectations of an economic downturn.

The last quarter of 2023 saw a marked increase in satisfaction among businesses: firms confident in their current situation rose from 24% in Q3 to 32% in Q4. The outlook for Q1 2024 is also positive, with 29% of businesses viewing their prospects as 'excellent' or 'good' – a sign of diminishing concerns, as extreme worries fell from 9% to 5%.

Looking ahead, Vietnam's business sector is poised for growth. 31% of companies plan to expand their workforce in Q1 2024, and 34% intend to increase their investments, a clear uptick from 2023. These statistics signal a strong momentum for growth and opportunity as Vietnam begins 2024.

Vietnam's rising star in global investment

In Q4 2023, Vietnam's investment hotspot status increased significantly. An impressive 62% of those surveyed ranked Vietnam among their top ten global investment destinations, with 17% placing it at the very top. This strong endorsement is matched by 53% of respondents anticipating increased foreign direct investment in Vietnam by the end of Q4.

The survey also highlights Vietnam's strategic position in the ASEAN region. While only a small fraction (2%) consider it an 'industry leader', a noteworthy 29% rank it among the 'top competitive countries' in ASEAN. The majority (45%) view Vietnam as a competitor, albeit acknowledging certain challenges. This perspective emphasises Vietnam's growing influence and potential for further advancement within the ASEAN economic landscape.

Vietnam's workforce: an assessment of proficiency and availability

The survey sheds light on the European business community's nuanced assessment of Vietnam's workforce. The statistics reveal a complex picture: while 32% of respondents recognise good proficiency in the workforce, this number indicates that a majority perceive room for improvement in skills and expertise. Similarly, the 24% satisfaction rate regarding workforce availability suggests that while there is a pool of talent, it might not fully align with the specific requirements or scale desired by international businesses.

The findings also show that 40% of respondents view Vietnam's workforce as moderately proficient, indicating a blend of basic and intermediate skills. In addition, 50% rate the workforce's availability as moderate, reflecting some challenges in finding qualified candidates. These results suggest that further development and training could enhance workforce proficiency and availability to better meet the demands of the global market.

Vietnam's regulatory challenges and opportunities

Through the survey, valuable insights emerge regarding the regulatory challenges perceived by the business community in Vietnam. Topping the list, a significant 52% of respondents identify 'administrative burdens and bureaucratic inefficiencies' as one of the top three hurdles, spotlighting the impact of red tape on business operations. Following this, 34% of businesses highlight 'unclear and variably interpreted rules and regulations' as a major challenge, emphasising the need for clarity and consistency in legal frameworks.

Securing necessary licences, permits, and approvals is a concern for 22% of respondents, pointing to procedural barriers in business activities. Moreover, 20% cite the 'lack of qualified local expertise in specialised fields' as a critical issue, suggesting a talent gap that needs addressing. Furthermore, 19% of companies find 'visa regulations, work permits, and labour rules for foreign employees' challenging, reflecting the complexities of managing an international workforce under the current legal system.

On the solutions front, the survey highlights key areas for improvement to boost Vietnam's attractiveness for FDI. A notable 54% of respondents call for 'administrative and bureaucratic streamlining', indicating that easing bureaucratic processes could significantly enhance the business environment. Additionally, 45% stress the importance of 'strengthening the legal system and regulatory environment,' while 30% see 'infrastructure development, including roads, ports, and bridges,' as essential for FDI attraction.

EU-Vietnam Free Trade Agreement: gains and challenges in 2023

In 2023, the potential of the EU-Vietnam Free Trade Agreement (EVFTA) was increasingly realised by businesses. By Q4, a significant 27% of companies reported experiencing 'moderate' to 'significant' benefits from the agreement, a marked increase from just 18% in Q2. The foremost advantages of EVFTA were 'tariff reductions or eliminations' (42%), 'increased market access to Vietnam' (27%), and 'improved competitiveness in Vietnam' (25%), indicating substantial economic impacts.

However, the survey also reveals challenges in fully leveraging EVFTA's potential. About 13% of respondents cited 'Uncertainty or lack of understanding of the agreement' as a primary obstacle, suggesting a need for more clarity and education around the agreement's provisions. On top of that, 9% pointed to 'Opaque and lengthy customs clearance procedures' as a hindrance, highlighting inefficiencies that could dampen the benefits of the trade agreement.

EuroCham Chairman Gabor Fluit’s comments:

“Confidence among the foreign business community in Vietnam is clearly on the rise. New data for 2023 support this. Last year, foreign direct investment reached $36.61 billion, jumping 32.1% from 2022. This is a clear illustration of growing faith in Vietnam's economy.

Tourism also rebounded strongly. By welcoming over 12.6 million visitors in 2023, Vietnam has more than tripled international tourist numbers from the year before. This global spotlight on Vietnam as a top destination for business travellers and tourists also signals broader economic recovery.

While these figures are indeed promising, it's crucial to maintain a cautious outlook. It's noteworthy that the BCI still remains below the midpoint, and more than one-third of businesses still expect to underperform.

Given the intense economic competition in the region, Vietnam should stay vigilant. It's crucial for the country to keep refining its policies and strategies to draw and maintain European foreign direct investment. One vital area to focus on is simplifying administrative procedures, a well-known obstacle for businesses. At the same time, investments in infrastructure to reduce logistics costs and upgrade the skills of the workforce are equally essential. This will help Vietnam stay competitive and maintain its growth trajectory.

Considering this, as we look towards the future, the importance of Vietnam leveraging the EVFTA only increases. This agreement, together with Vietnam's various bilateral and regional trade pacts, is expected to play a key role in transforming the current economic recovery into long-term, balanced growth. Throughout this ongoing process, EuroCham Vietnam remains wholeheartedly committed to playing a supportive role.”

Decision Lab CEO Thue Quist Thomasen's perspective:

"Vietnam's long-term economic trajectory suggests a promising path of continued growth. In the short and medium term, Vietnam is showing its trademark ability to deliver a stable business climate even in turbulent times, as we observe the fifth quarterly measurement within the range of 40 to 50 index points. Continued stability and potential improvement in 2024 will underpin the case for further Foreign Direct Investments in the country."

About the Business Confidence Index:

The quarterly Business Confidence Index (BCI), which is conducted by Decision Lab, serves as a vital tool for understanding the perceptions of European and Europe-related companies and investors in the Vietnamese market. Conducted since 2011, the BCI collects feedback from EuroCham Vietnam's extensive network of 1,400 members across a diverse range of sectors. This survey provides valuable insights into the current business landscape in Vietnam and offers a glimpse into future expectations.

Decision-makers, media, and business professionals see the BCI as a key indicator of economic activity in the country. It is a trusted source of information on the business environment in Vietnam, and its findings are widely used to inform government policies and investment decisions.