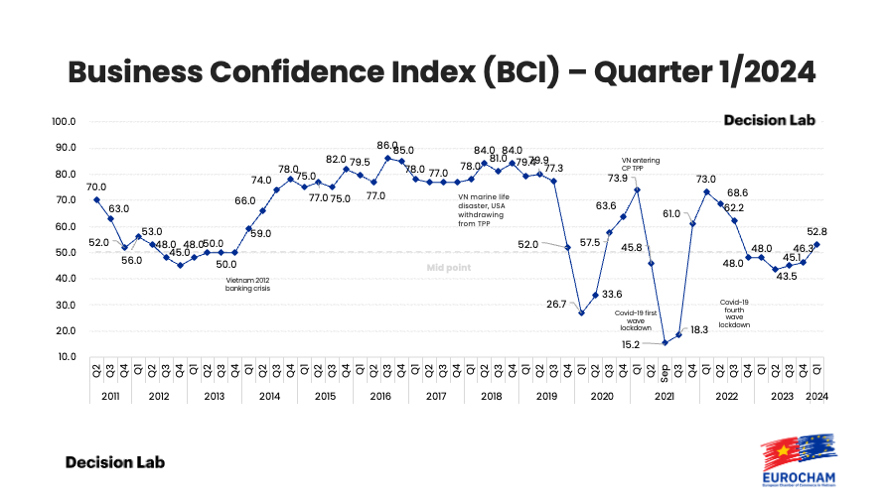

The European Chamber of Commerce in Vietnam’s (EuroCham) most recent Business Confidence Index, conducted by Decision Lab, has signaled optimism in Vietnam's economy. The quarterly index reached 52.8 in Q1 2024 – its highest level since Q3 2022 – a clear sign of increased confidence within Vietnam’s European business community.

Sent to EuroCham's network of over 1,400 members, the BCI gathers responses to gauge the prevailing mood among European businesses operating in Vietnam, delivering real-time observations into the ever-evolving dynamics of the vibrant Southeast Asian market.

To read the full Q1 2024 Business Confidence Index report, click here.

"This positive trend underscores the European business community's view of Vietnam as a dynamic market with promising growth prospects,” said EuroCham Chairman Dominik Meichle. "The index once again rising above the 50 threshold reaffirms the country's growing appeal. Continued efforts to enhance stability and predictability will further strengthen Vietnam's global competitiveness and unlock its full potential."

"The hard data from the Business Confidence Index paints a clear picture - investor optimism is steadily improving," said Decision Lab CEO Thue Quist Thomasen. "Vietnam certainly has the capacity to become the region's preeminent investment destination, and proactive, investor-focused policies will further accelerate its rise.”

European investors recommend Vietnam

European businesses signal a strong likelihood of recommending Vietnam as a top investment destination. A significant 54% of those surveyed indicated a high likelihood of recommending the country to other foreign businesses, giving ratings of 8 or above out of 10. This highlights Vietnam's rapidly growing appeal within the European business community, while also suggesting potential to further increase its attractiveness to investors.

Confidence fuels Vietnam’s growth

European businesses express optimism about Vietnam's economy, both in the near and long term. While a third of businesses feel optimistic about their individual Q2 outlooks, and nearly 40% are neutral, several key indicators point toward a promising trajectory:

- Optimism on the Rise: Sentiment shifted positively for the upcoming quarter regarding the overall economy. Optimism is up 6 points from last quarter to 45%, while pessimism is only 10%.

- More Revenue Expected: Over half of respondents anticipate higher orders and revenues in Q2 2024.

- Jobs Outlook Robust: 40% of businesses plan to expand their workforce in Q2.

- Investment Confidence Rises: The reduction of the number of firms planning to cut spending in the upcoming quarter, now just 15% compared to the previous 23%, indicates a boost in investment confidence.

Looking to the long term, this optimism strengthens, with 71% of businesses feeling positive about their long-term prospects in Vietnam over the next five years.

Vietnam's talent advantage

Vietnam's skilled workforce is a major draw for European investors, with 75% of EuroCham members hiring 76% or more of their staff locally. While a Q4 2023 BCI survey found 40% of businesses rating workforce proficiency as moderate, the strong hiring trend suggests a solid talent foundation for future growth.

Regulatory hurdles and solutions

While optimism remains high, businesses face regulatory hurdles in Vietnam that hinder market entry and long-term investment. Key concerns include:

- Administrative Burdens: Over half of respondents cite these as a major obstacle to both establishing and expanding operations.

- Unclear Regulations: 36% grapple with confusing rules, creating uncertainty and impeding strategic planning.

- Permit and License Difficulties: 28% experience costly delays in obtaining approvals, discouraging new ventures and adding risk for investors.

- Work Visa Barriers: Restrictive rules (26%) stifle skills transfer and discourage foreign expertise and capital that drive growth.

To attract more foreign investment, businesses pinpointed several key reforms:

- Simplify Administration: 37% call for streamlined procedures to ease market entry and reduce red tape.

- Strengthen Legal Framework: 34% emphasize clear and consistent laws for a predictable investment climate.

- Enhance Infrastructure: 28% advocate for the enhancement of roads, ports, and bridges to support trade and logistics.

"Vietnam has tremendous economic potential, and addressing regulatory challenges is key to fully realizing it," said Meichle. "Streamlining procedures and establishing more transparent regulations will empower both Vietnamese and foreign businesses to succeed. This will position Vietnam as a leading investment destination in the region, benefiting domestic businesses, attracting international capital, and strengthening economic partnerships."

EuroCham's 2024 Whitebook offers detailed recommendations to streamline regulations and create a more welcoming investment climate. Click here to read it.

Sustainability: a hurdle for some

While Vietnam continues to make progress on sustainability, the European business community faces challenges in adapting. Key hurdles include:

- Limited Consumer Demand: 30% of businesses find it difficult to justify eco-friendly practices due to low consumer interest.

- Cost vs. Sustainability: 26% struggle to balance cost competitiveness with sustainability commitments, specifically citing pricing conflicts with eco-practices.

- Unclear Regulations: 26% find it difficult to comply with unclear or confusing environmental regulations.

- Infrastructure Gaps: 25% lack the infrastructure needed for sustainable operations, including access to renewable energy and waste management solutions.

The EuroCham Green Economy Forum & Exhibition (GEFE) 2024, taking place on October 21-23 in Ho Chi Minh City, is designed to bridge these gaps and empower businesses to thrive in the new green landscape. Read more about GEFE 2024 here.

Businesses watch for policy impacts

Businesses are closely tracking several upcoming regulatory shifts that hold the potential to significantly reshape their operating environment. Key areas businesses are watching include:

- Power Development Plan (PDP) VIII: Cited by 21% of businesses. The recent approval of PDP8's implementation plan (April 1) could provide clarity or introduce new complexities for businesses within the energy sector.

- Pharma Law: 11% of businesses anticipate substantial impacts from changes to the pharmaceutical regulatory framework.

- Land Law: The recent revisions to the Land Law, ratified by the National Assembly (NA) on January 18, 2024, are noted by 7% of businesses as a potential area of impact.

- Other Policies: Businesses are also monitoring developments in the Carbon Border Adjustment Mechanism, Direct Power Purchase Agreements, and the General Data Protection Regulation (each cited by 5%). These regulations have the potential to influence industries ranging from manufacturing to technology.

Supply chain risks highlighted

Recent disruptions in crucial shipping lanes like the Red Sea have adversely affected three out of five respondents, highlighting the vulnerability of global supply chains. This underscores the importance of Vietnam exploring all possible measures to mitigate the impact of such external risks on its economy.

Revival amidst headwinds

While economic uncertainties, real estate headwinds, and supply chain risks pose challenges, the data shows European businesses are optimistic about near-term revival and longer-term prospects in Vietnam's ascendant market. As the country advances, the European business sector is poised to seize opportunities while advocating reforms to sharpen Vietnam's competitive edge.

To read the Q1 BCI full report, click here.

About the EuroCham Business Confidence Index survey:

The quarterly Business Confidence Index (BCI), which is conducted by Decision Lab, serves as a vital tool for understanding the perceptions of European and Europe-related companies and investors in the Vietnamese market. Conducted since 2011, the BCI collects feedback from EuroCham Vietnam's extensive network of 1,400 members across a diverse range of sectors. This survey provides valuable insights into the current business landscape in Vietnam and offers a glimpse into future expectations.

Decision-makers, media, and business professionals see the BCI as a key indicator of economic activity in the country. It is a trusted source of information on the business environment in Vietnam, and its findings are widely used to inform government policies and investment decisions.