As 2023 comes to an end, let’s reflect on our insightful year in Vietnamese market research. Our reports, attracting over 14,000 downloads last year, have revealed key consumer trends. In this blog, we distil these findings into our top five insights into Vietnamese consumers.

They encompass the innovative blend of shopping and entertainment, cautious financial behaviour in uncertain times, the preferred balance of hybrid work, the splurge in premium dining, and Gen Z's lean towards digital disconnection.

These insights not only reveal current consumer preferences but also guide brands towards future strategies in the vibrant Vietnamese market.

Vietnamese shoppers indulge themselves in shoppertainment

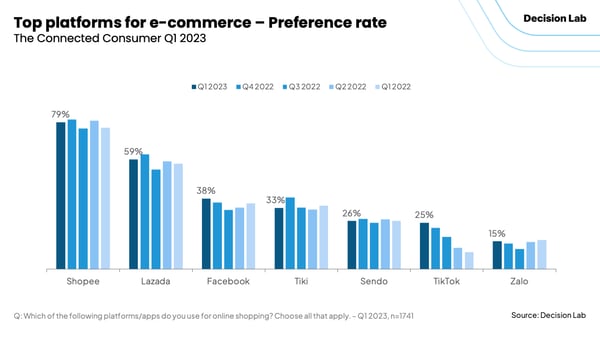

Shoppertainment is the key development for Q1 2023. While all the big e-commerce players’ usage dropped, TikTok Shop grew an impressive 5% quarter on quarter. This concept merges shopping and entertainment, leveraging live streams and engaging content to make shopping more interactive and enjoyable.

Decision insight: Vietnamese shoppers are looking for more dynamic and fun online shopping experiences, allowing brands to engage their audience innovatively.

Learn more about this insight.

They are increasingly cautious financially

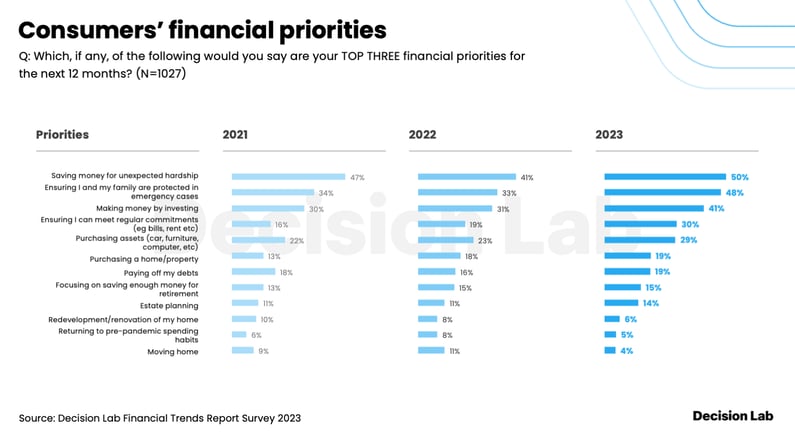

Vietnamese consumers are increasingly cautious financially due to economic uncertainties, according to Decision Lab Financial Trends Report 2023. Half the respondents said saving for unexpected hardship was their biggest concern. That is an increase of almost 10% compared to 2022 and 3% higher than 2021 when Vietnam was in the midst of the COVID pandemic.

Investment trends show a 10% growth in those using investment products for financial security, yet there's a decline in risk tolerance, with high-risk investors halving to 9%. Safe-haven investments like savings accounts and securities have surged.

Decision insight: Banks and financial institutions looking to attract customers need to provide savings and investment products offering trustworthiness, transparency, and security while showcasing these values through their marketing messages and brand campaigns.

Learn more about this insight.

They prefer the hybrid working mode

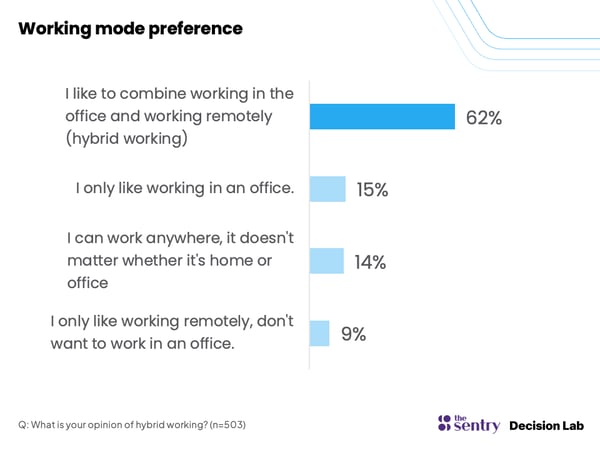

62% of Vietnamese employees prefer hybrid working mode, according to the Thought Leadership Report “The Future of Work” by The Sentry and Decision Lab. However, only 9% of employees said they only like working remotely, which suggests that people still value the social and professional benefits of going to offices.

"Learning opportunities" is the top priority for 47% of employees when choosing a workplace, followed by "company culture" and "income & benefits" with both 46%.

Decision insight: The report reveals what drives employees' choice of workplace, their definition of an ideal workplace, and their perception of new workplace trends. It provides valuable insights for employers to create a productive and sustainable workplace.

Learn more about this insight.

They fancy expensive meals

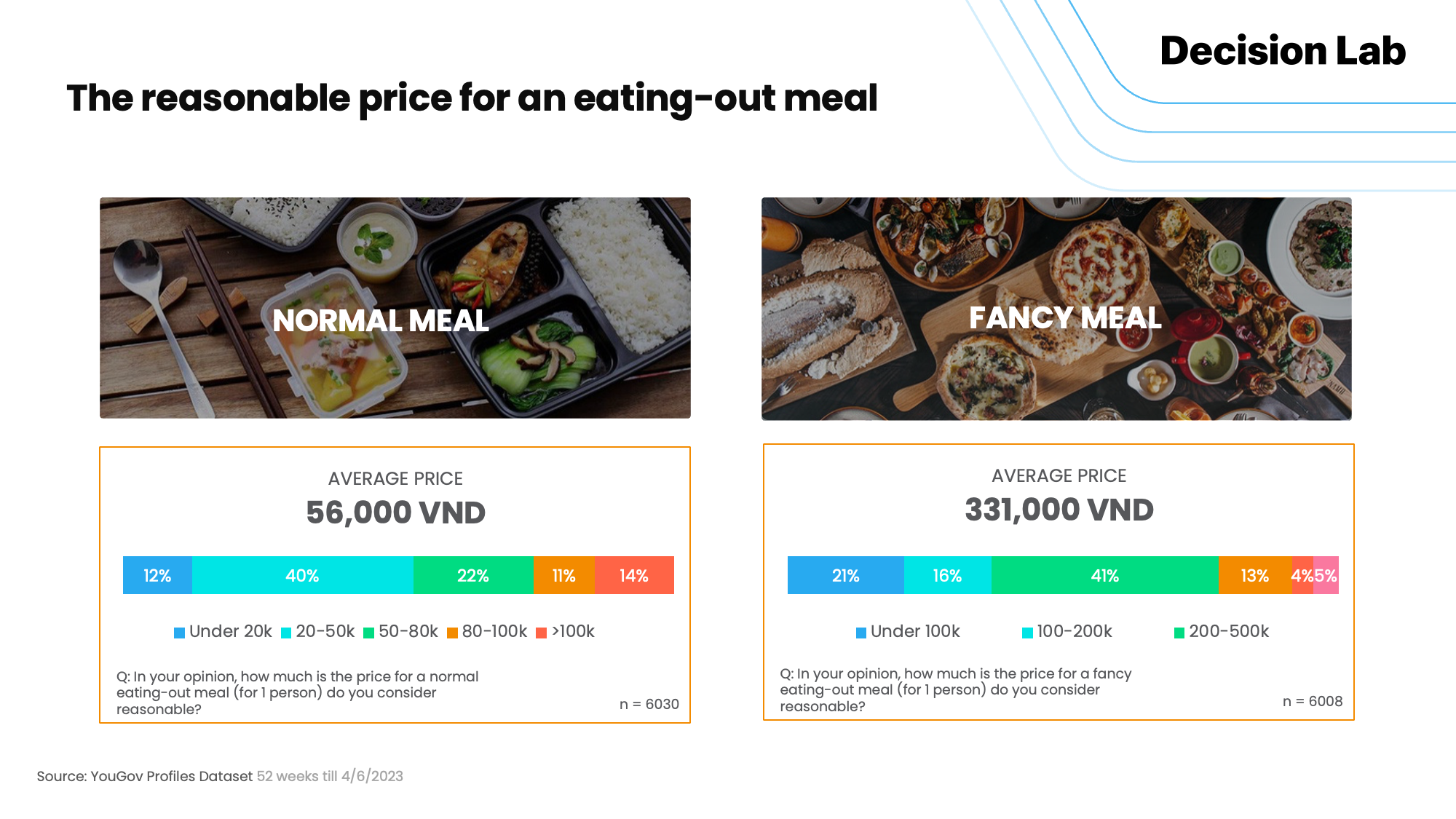

According to the F&B Trends in Vietnam 2023 report, the average reasonable price for a normal meal out is 56,000 VND per person. For a fancy meal, the average reasonable cost goes up to 331,000 VND per person, which is approximately six times more expensive than a regular meal.

Decision insight: Higher-income consumers tend to spend more on F&B. Offering discounts/promotions can help retain customers at restaurants/cafes. Financial constraints (20%) and lack of promotions (18%) are two main reasons for reduced spending on eating out.

Learn more about this insight.

Vietnamese Gen Z wants to disconnect

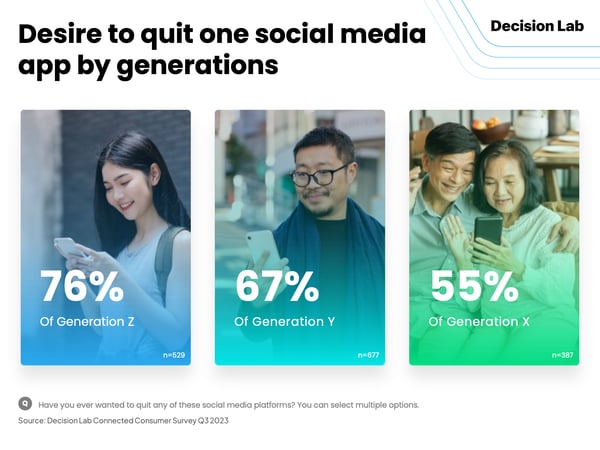

Almost eight out of ten (76%) of Gen Z want to quit at least one social media platform, according to the Connected Consumer Q3 2023. This suggests a need to regain control over their time and mental space.

Decision insight: As Gen Z paves the way for more mindful social media consumption, authenticity, relevance, and responsible digital engagement will be the cornerstones of future brand strategies.