The addictive nature of playing games on mobile phones has seen advertising revenues in this segment of the mobile entertainment market explode in the ASEAN region. A report by POKKT, in association with the Mobile Marketing Association (MMA) and Decision Lab, takes a look at four of its biggest markets.

Thailand and the Philippines lead the way

With over 1.1 billion players across devices* in the APAC region alone, in-app mobile gaming has quickly made its way into the daily routine of not only Gen Z’s and Millennials, but also of those we might have previously considered ‘late-adopters’ to the mobile era in Southeast Asia.

So powerfully addictive are these simple, intuitive games, usually based on some element of strategy, puzzle-solution or easy-to-follow arcade play, that across the region, market penetration has reached up to two-thirds of the total online population. Thailand and the Philippines lead the way, with 67% of all mobile users identifying as mobile gamers in these countries. Vietnam and Indonesia are catching up, with 56% each.

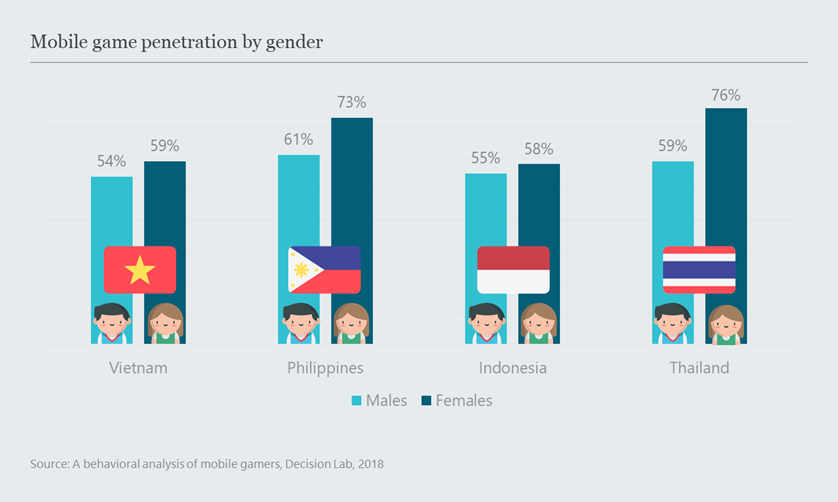

Women driving the phenomenon

In opposition to previous stereotypes about gamers (adolescent boys holed up in cybercafes), the report paints a very different picture of who’s driving this growing phenomenon. In large part, it’s women, particularly in Thailand and the Philippines, where penetration amongst the ‘fairer’ sex is 76% and 73%, respectively, compared to 59% and 61%, respectively, for males. In Indonesia and Vietnam, the gender split is less pronounced, but both are into the mid-to-high 50s.

In general, male players prefer strategy games and women prefer puzzle-based ones, particularly Philippino ‘Moms’ (67%), while sports and racing-based games are consistently ranked in the bottom 4.

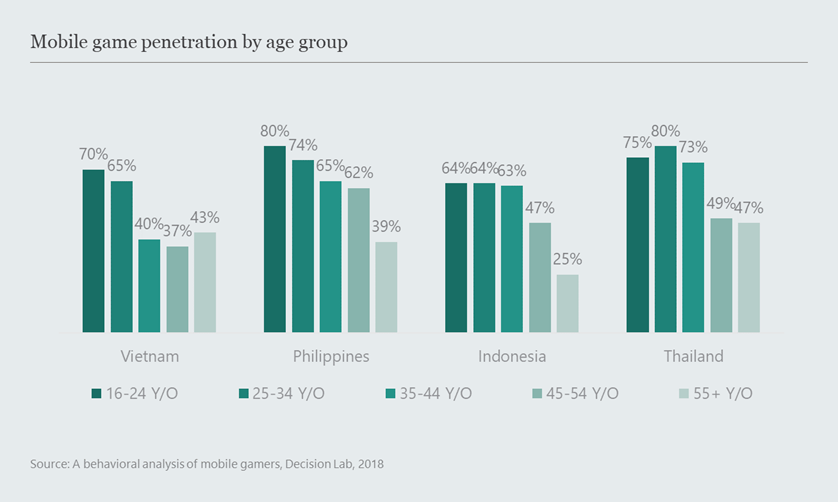

Surprising to some, though not to those who love to play, will be the popularity of mobile gaming with a slightly older than expected age group. Here again, the Philippines leads the way, with consistent market penetration of more than 60% amongst mobile users 35-55 years old. In Thailand, while this number drops off to just under 50% for 45 year-olds and above, up to 80% in the 16-44 year-old categories equates to a highly engaged audience of millions.

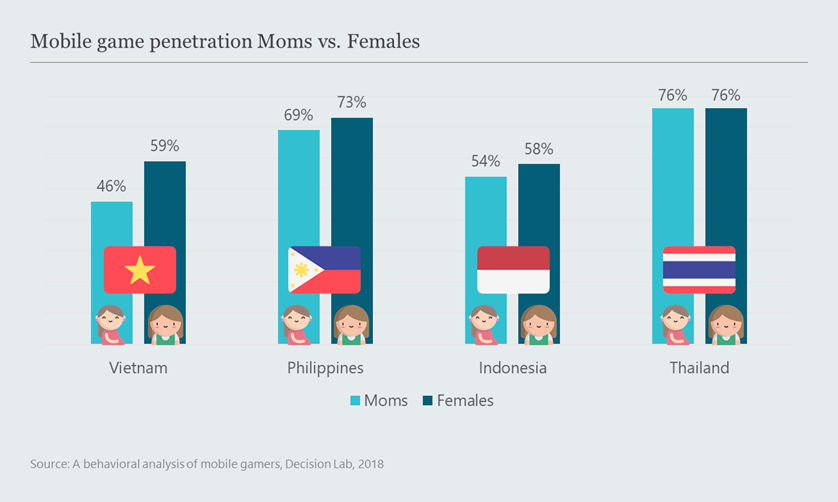

Moms are significant audiences

Underscoring women’s role as drivers of this phenomenon, ‘Moms’ are a significant audience. This is especially true of those with younger children, where for example in Thailand, their average session time is as high as 66 minutes per session; significantly higher than in Vietnam, where this number is 43 minutes.

Consistently, mobile gamers in Southeast Asia love playing at home, where they can be distracted by a multitude of other media, or be totally focused. Easily the most popular time to play is between the hours of 7PM and 10PM, especially if you’re a Vietnamese Mom, where this number is the highest in the region at 91%. Women generally are also more likely than Men to play during the hours of 12PM and 2PM, except in Indonesia, where this figure is more even (45% of men v. 47% of women).

Rewarded video ads consistently score high

Asked in the Decision Lab survey about their willingness to accept ad content while playing, there are some slight differences between the countries. However, as a general rule, brand or promotion ads of new products faired better, with the exception of Thailand, where gamers are more comfortable being interrupted by brand ads of pre-existing products or services.

A reward for watching ads in the form of a bonus or incentive is shown to have an impact on the willingness of players to watch them, whether they be static, interactive or video ads. No gamers like ads, but very few are willing to ‘upgrade’ to avoid them entirely. Rewarded video ads score the highest across all four countries for likeability, and are the ad format most likely to engage active gamers.

To download the full report click here.

*The GMGC Mobile Games Whitebook, New Zoo, Q1 2017