Spring brings new energy, luck, and prosperity -so everybody hopes. However, for operators in the foodservice industry, this may not have been the case for the first few months of 2017.

According to an industry report by Decision Lab, Quarter 1 2017 was the cruelest quarter for restaurants in the Vietnam’s three biggest cities with a 9% decrease in visits and average spend down by 12%. The quarter closed with 20% lower total sales value than Quarter 4 2016.

However, for industry experts, this may not come at a surprise as running a foodservice outlet is indeed very much a seasonal business. Talking about Quarter 1 specifically, there are many peculiarities that can explain why the market turned sluggish.

First and foremost, Lunar New Year is the single biggest holiday of the year for Vietnamese consumers. In order to prepare for a proper celebration, people often save money by cutting down on unnecessary expenditure like eating at restaurants.

Besides the urge to save, Vietnamese consumers also have a higher tendency to gather together and spend more time with family by cooking and eating at home together at this time of the year. People also start to travel more often during this long holiday. All of these contribute to a significant drop in visits to restaurants in general.

However, it is not impossible for operators to embrace the seasonality of this business. With a proper understanding of consumers, restaurants can even ride the waves. So, what should operators keep in mind about your consumers’ behavior during quarter 1?

Consumers tend to pick cheaper outlets

Consumers tend to pick cheaper outlets

Saving money does not mean not eating/drinking outside at all. It means compromise by finding a place that can serve your basic needs and not hurt your pocket at the same time.

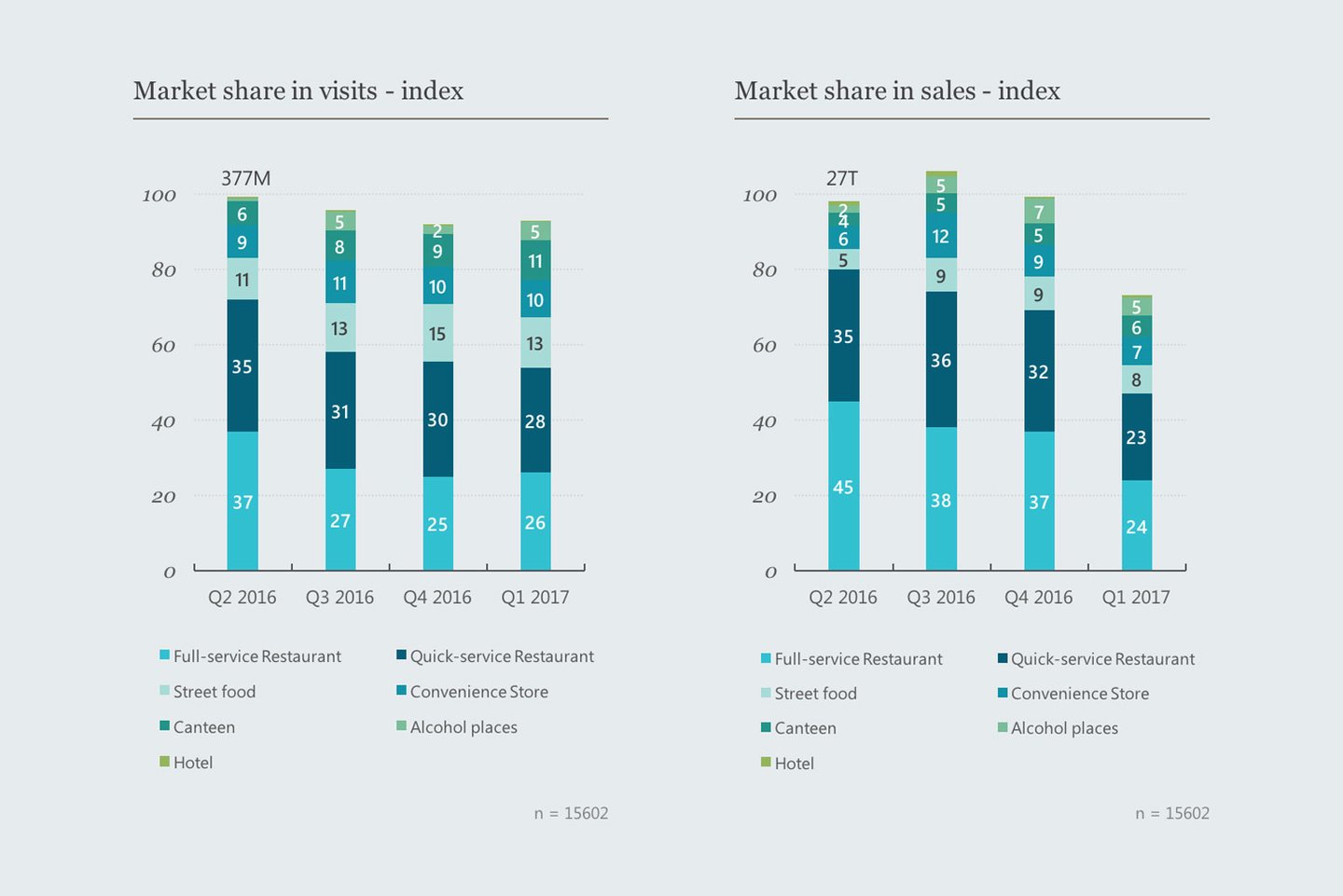

The data collected from Decision Lab’s Foodservice Monitor indicates that both Full-service restaurants (FSR) and Quick service restaurants (QSR) experience a decline in sales and visits in quarter 1. Meanwhile, the channels with lower average spending per head – Street food and Convenience store (CVS) managed to maintain their market size.

To compete with low-end channels, operators in the up-market channels should consider seasonal deals/menu items that are more in line with consumers’ willingness to pay at this sensitive time of the year.

Consumers would eat out less for main meals

Consumers would eat out less for main meals

As Vietnamese consumers began saving for the biggest celebration of the year, they cut down on going to restaurants for Breakfast, Lunch, and Dinner, both in terms of visits and spending.

A little mid-day snacking might be harder to resist, which might be why Afternoon snacks remained stable in terms of visits share. Consumers did spend slightly less for this occasion, however.

With consumers perceiving eating main meals out as something that is generally costlier and to be restricted at this time of the year, operators should prepare special snacking menus at an affordable price range in order to have a better chance of winning consumers.

Consumers would hold on to delivery orders

Consumers would hold on to delivery orders

As the quarterly Foodservice Monitor report from Decision Lab shows, Delivery is the only type of consumption that enjoys stability in its market size in quarter 1. Vietnamese still highly value the convenience of placing a delivery order, having their meal cooked by professional chefs and delivered to their doorstep. Especially before, during and after Lunar New Year when everyone is swamped with work, holiday preparation, and traditional rituals, the comfort a delivery can bring is even more appreciated.

Although not cutting down on delivery per se, consumers did spend less per order as they stayed committed to their saving plan. To tackle this lower spending per order, restaurants can offer promotions that encourage more frequent orders from consumers. Operators should also consider offering snacks/drinks at lower price point, and cooperate with third party order platforms that take care of the delivery to save themselves on delivery cost.

Hungry for more? Get our latest report here.

About Foodservice Monitor

Foodservice Monitor gathers information daily on out of home consumption in Vietnam and presents this in the accessible reports for subscribers, providing a complete overview of restaurant visits, spend, types of food & drink consumed, reasons/motivations for consumption, eating occasions, the location of the restaurant and much more.

Read more about Foodservice Monitor here

Purchase the latest report here

Consumers would eat out less for main meals

Consumers would eat out less for main meals Consumers would hold on to delivery orders

Consumers would hold on to delivery orders